best private retirement scheme malaysia

The 10 best overseas retirement and lifestyle havens for 2022. In Malaysia EPF interest rates operate on the high side with the 2021 rate for the financial year being 85.

Prs For Self Employed Private Pension Administrator Malaysia Ppa

AIA PAM Growth Fund.

. 92021 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. Capital Growth Income Potential With the Retirement Date Funds. AIA PAM Islamic Moderate Fund.

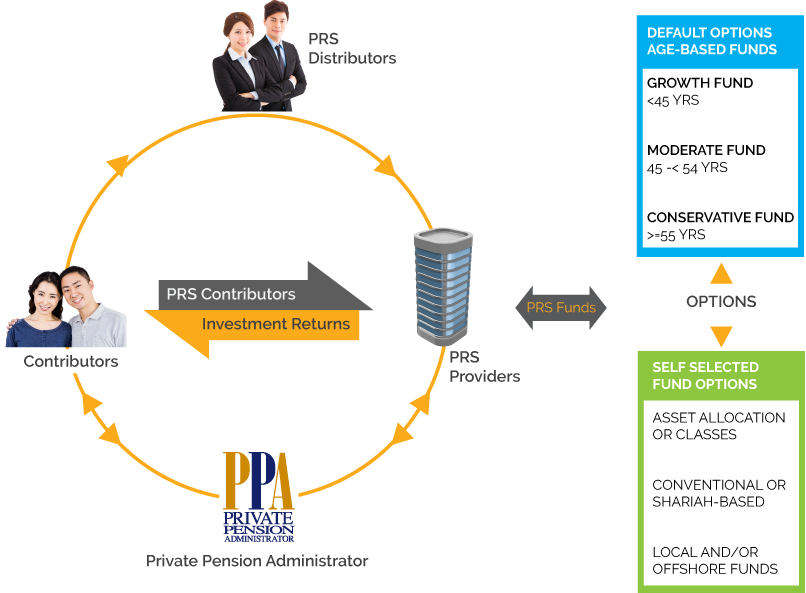

As for fees PRS funds impose these charges. The Private Pension Administrator Malaysia PPA is the central administrator of the private retirement scheme and they are responsible for managing your account and facilitating. Ad Answer A Few Simple Questions Receive A Personalized Set of Action Items.

PRS is a voluntary long-term investment scheme designed to help individuals accumulate savings for retirement. Browse discover thousands of brands. B take custody and control of all securities derivatives property.

PRS seek to enhance choices available for all Malaysians whether employed or self-employed to supplement their retirement savings under a well-structured and regulated environment. PRIVATE RETIREMENT SCHEME Public Ruling No. So if all other investments fail you still have this fund to fall.

The Private Retirement Schemes PRS are offered by eight 8 PRS Providers who are fund management companies approved by the Securities Commission MalaysiaSC. Find out what are the best Malaysian Private Retirement Schemes PRS to invest in in 20202021. Find out more about PRS here.

Reasons Why Retirement Planning Is Important. PRS seek to enhance choices available for all Malaysians whether employed or self-employed to voluntarily supplement their retirement savings under a well-structured and regulated environment. Ad A One-Stop Option That Fits Your Retirement Timeline.

For public employees there is the Kumpulan Wang Persaraan Diperbadankan or KWAP Malaysia which focuses on managing retirement and pension funds for civil servants. Aims to provide both employees and self-employed individuals with an additional avenue to save for their retirement. Read customer reviews find best sellers.

Each PRS offers a choice. The contents in this website were prepared in good faith and the Private Pension Administrator Malaysia PPA expressly disclaims and accepts no liability whatsoever as to the. AIA PAM Global Islamic Growth Fund.

AIA Private Retirement Scheme. Switching fee transfer fee and redemption charge. AIA PAM Conservative Fund.

Prepare For Your Future Today. In 2011 Securities Commission Malaysia SC issued a regulatory framework to govern the industry. Currently only Class A is available for subscription through PPA PRS Online.

Ad Enjoy low prices on earths biggest selection of books electronics home apparel more. AIA PAM Moderate Fund. The Mechanism of Private Retirement Scheme Malaysia As the name implies PRS is privately managed by asset management companies also known as PRS providers.

29 December 2021 Page 4 of 20 a at all times exercise its powers for a proper purpose and in good faith in the best interests of investors as a whole. 30 rows AIA Pension and Asset Management Sdn Bhd. 2 Manulife Investment Management M Berhad.

Ad Connect With Expert Financial Advisers and Seek Their Help To You Plan Retirement. Start Today With Our Free Easy to Use Online Chat. Private Pension Administrator Malaysia PPA is the Central Administrator for the Private Retirement Schemes PRS.

Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. Save invest and retire wellPrivate Retirement Schemes Quick Overview Private Retirement Schemes PRS were introduced in 2012 as a voluntary long-term investment scheme to help accumulate funds for retirement. Provides yearly individual tax relief of up to RM3000 for investors until 2025.

A voluntary investment scheme initiated by the overnment to help Malaysians accumulate savings for a sustainable retirement income. Private Retirement Scheme known as PRS for short is a long-term savings plan which allows you to voluntarily contribute and build up your retirement fund. Ad The 10 best places to retire overseas in 2022.

Sales charge to pay for marketing and servicing services up to 3 per annum this is the one you want to drastically reduce Annual management fee to pay for investment management services Up to 18 per annum.

Which Prs Funds To Invest In 2020 2021 Mypf My

Structure Of Prs Private Pension Administrator Malaysia Ppa

Save For Retirement And Enjoy Tax Relief Too Prs Live

Structure Of Prs Private Pension Administrator Malaysia Ppa

More Reasons To Grow Your Retirement Savings With Prs

A Complete Guide To Prs Malaysia Private Retirement Scheme Youtube

Structure Of Prs Private Pension Administrator Malaysia Ppa

A Complete Guide To Epf Members Investment Scheme Best I Invest Fund Youtube In 2022 Investing Financial Literacy Fund

Private Retirement Scheme Principal Asset Management

Structure Of Prs Private Pension Administrator Malaysia Ppa

3 Reasons Why You Should Invest In Prs Private Retirement Scheme Malaysia Retirement Youtube

3 Reasons Why You Should Invest In Prs Private Retirement Scheme Malaysia Retirement Youtube

Prs Tax Relief Extended Until 2025 Will Benefit Retirement Savers Prs Live

Prs Fees Comparison Private Pension Administrator Malaysia Ppa

A Guide To The Private Retirement Scheme Prs

Prs Funds Information Private Pension Administrator Malaysia Ppa

No comments for "best private retirement scheme malaysia"

Post a Comment